By Luke Baldwin

We often get asked - what exactly is ILA within a property and finance transaction? You are being

told by your Lender or Solicitor that you must go and get an “ILA”, yet the why is often not explained

clearly or confusing. So, what’s the why?

This guide hopes to answer that question. It traces ILA’s historical roots, analyses landmark UK court

decisions, explores recent research, and explains why iLA Law should be your trusted go to when ILA

is needed.

The Origins of Independent Legal Advice: Addressing Undue Influence

The requirement for ILA stems from the equitable doctrine of undue influence, with roots in English

law from the 18th century. Developed in the Chancery Court, this doctrine protected vulnerable

individuals from exploitation in agreements, especially in trusted relationships. In Huguenin v

Baseley (1807) 14 Ves Jr 273, a widow’s gift to her clergyman advisor was set aside due to undue

influence, establishing that transactions could be voided without free consent, laying the foundation

for ILA.

By the 19th century, courts applied this to family settings. In Allcard v Skinner (1887) 36 Ch D 145, a

woman’s donation to a religious group was challenged, with the court noting no independent

advice, though relief was denied due to delay. In the early 20th century, as lending grew, Bank of

Montreal v Stuart [1911] AC 120 voided a wife’s guarantee of her husband’s debts due to no

independent advice. In Lloyds Bank Ltd v Bundy [1975] QB 326, decided on 30 July 1974, an elderly

farmer’s guarantee for his son’s loan was set aside, as the bank’s influence and lack of advice

created an unfair advantage (see case details).

In Avon Finance Co Ltd v Bridger [1985] 2 All ER 281, an elderly couple charged their home for a loan

arranged by their son, who exerted undue influence. The court voided the charge, citing no

independent advice and the lender’s failure to ensure consent, reinforcing ILA’s role in family

transactions. Bank of Credit and Commerce International SA v Aboody [1989] 2 WLR 759 found a

wife’s guarantee was influenced by her husband, criticising brief legal advice, though upheld due to

no “clear disadvantage.” National Westminster Bank plc v Morgan [1985] AC 686 required a “clear

disadvantage” for undue influence, noting the absence of advice as key (see case details).

These cases showed the risks for individuals in close relationships pledging assets like homes. By the

late 20th century, with growing use of family homes as loan collateral due to economic shifts, ILA

became formalised to ensure informed, pressure-free decisions, requiring solicitors to advise on

risks like home loss without borrower or lender influence.

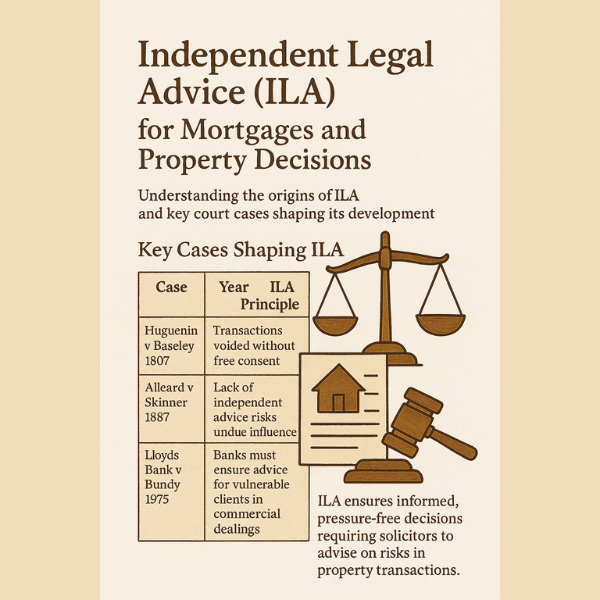

Key Cases Shaping ILA

Case Year ILA Principle

Huguenin v Baseley 1807 Transactions voided without free consent, needing

independent advice.

Allcard v Skinner 1887 Lack of independent advice risks undue influence in trusted

relationships.

Bank of Montreal v Stuart 1911 Guarantees set aside without independent advice in familial

contexts.

Lloyds Bank v Bundy 1975 Banks must ensure advice for vulnerable clients in

commercial dealings.

Avon Finance v Bridger 1985 Lenders responsible for ILA in non-commercial family

transactions.

BCCI v Aboody 1989 Advice must be thorough to counter undue influence

effectively.

National Westminster v

Morgan 1985 Absence of advice key in assessing undue influence with disadvantage.

The Foundation: Barclays Bank plc v O’Brien (1993)

The modern framework for ILA was set in Barclays Bank plc v O’Brien [1993] UKHL 6, decided on 21

October 1993 (see case details). A wife guaranteed her husband’s business debts with the family

home, claiming she signed under pressure without understanding risks. The House of Lords ruled

lenders must be “put on inquiry” in non-commercial deals—where the signer gains no clear benefit,

like a spouse backing a partner’s loan. Lenders must ensure ILA to avoid agreements being voided if

undue influence is proven.

O’Brien built on Bundy, Bridger, and Aboody, addressing the rise of family homes as collateral in the

1980s and 1990s. It prompted banks to require ILA certificates, enhancing scrutiny of lending

practices.

The Cornerstone: Royal Bank of Scotland plc v Etridge (No 2) (2001)

Royal Bank of Scotland plc v Etridge (No 2) [2001] UKHL 44, decided on 11 October 2001, set a

definitive ILA framework (see case details). It reviewed eight cases, mostly wives mortgaging homes

for husbands’ business loans, claiming undue influence or poor advice. Lord Nicholls’ guidelines

balanced protecting individuals with supporting family-backed lending for small businesses.

Etridge’s Key ILA Guidelines

Lender’s Duty: Lenders must check for ILA in non-beneficial transactions, like a spouse’s

guarantee.

Solicitor’s Role: Solicitors must:

o Meet clients privately, face-to-face, without the borrower.

o Explain documents and risks (e.g., losing the home) clearly.

o Discuss loan details and alternatives.

o Warn of potential lender changes to terms.

o Confirm voluntary consent and issue an Etridge Letter.

Independence: Solicitors act only for the signer, free from conflicts.

Undue Influence: Non-commercial deals raise an assumption of influence, countered by ILA.

Etridge protected individuals while supporting loans vital for start-ups, reducing disputes by

clarifying standards. Solicitors failing these standards risk negligence claims.

Broader Impact of Etridge

Etridge transformed UK lending, with banks requiring written ILA confirmation. It raised borrower

awareness but highlighted challenges like ensuring solicitors have full loan details.

Reinforcing Solicitor Accountability: Kenyon-Brown v Desmond Banks & Co (2000)

In Kenyon-Brown v Desmond Banks & Co [2000] PNLR 266, a wife sued her solicitor for poor advice

on guaranteeing her husband’s debts with their home. The solicitor, also representing the husband’s

firm, failed to explain risks like repossession or ensure free consent. The court ruled the solicitor

negligent, stressing ILA’s need for independence and thoroughness.

Adapting to Modern Lending: Waller-Edwards v One Savings Bank Plc (2025)

In Waller-Edwards v One Savings Bank Plc [2025] UKSC 22 (see case details), decided on 4 June 2025,

a couple borrowed £440,000, with £39,500 for one partner’s debts. The other claimed undue

influence, unaware of the loan’s structure. The Supreme Court ruled that a “non-trivial” benefit to

one borrower triggers Etridge ILA duties, ensuring informed consent for hybrid loans (e.g., for home

improvements and debt consolidation). This reflects modern financial complexities, with iLA Law

adapting through our rigorous processes.

We’ve gone into more detail on this case here.

Societal Implications

Waller-Edwards ensures fairness in diverse financial relationships, increasing lender and solicitor

diligence, met by iLA Law’s tailored advice.

Modern Delivery: Video Call ILA

ILA has adapted to include video call consultations for convenience and affordability. At iLA Law, we

use secure platforms like Google Meet (or Zoom, Whatsapp or FaceTime if you prefer), ensuring

Etridge compliance with private, face-to-face meetings, clear risk explanations, and voluntary

consent.

Why ILA Matters Today

ILA ensures informed decisions in today’s complex financial landscape, protecting against home loss,

financial strain, or disputes. For lenders, robust ILA minimises challenges, as seen in Etridge and

Kenyon-Brown. With hybrid loans and diverse family structures, ILA remains vital.

Why Choose iLA Law for Independent Legal Advice?

We’re award-winning specialist ILA solicitors. This means that not only do we have specialist

knowledge, we’ve also designed every part of our process to be as efficient and hassle-free as

possible. From real-time availability to understanding lender-specific requirements, we’ve

streamlined everything to get your ILA done quickly, accurately, and without the usual legal fuss. It’s

as simple as that. You can find out more about the Team here.

What’s the iLA Journey?

We have set out our process here. But don’t worry, if you are not quite sure, just give us a call on

020 4571 9207 – we’re here to help you through every step of the way.

Disclaimer:

This article is for informational purposes only and does not constitute legal or financial advice. The

information is accurate as of 21 July 2025 and may be subject to change after this date. Readers

should consult qualified professionals for advice tailored to their circumstances.